Article Written By Jackson Titan, Grade 12 Investments and Finance, October 18th, 2021

Failed Business Model

Within the past four decades, the rapid increase of executive compensation as a means to offer incentives for better performance has placed a spotlight on how much executives are being paid. The pay gap between executives and the average employee has grown significantly over the years, which many believe to be unfair. We have been taught by large corporations and free market advocates to believe that an increase in benefits for executives will lead to good returns for its shareholders. While this may seem logical, I believe it is extremely counterintuitive to the reality of how destructive high executive compensation can be towards a corporation and society as a whole.

Is It Unfair to the Employee?

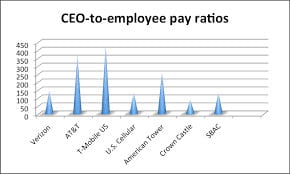

Last year, the average CEO made 299 times more than the average employee in the United States. Not only is this unfair to the working class, it can be detrimental towards employee productivity and morale. Having a workplace environment where employees are aware that their bosses make almost 300 times their annual salary heavily influences morale. This theory is backed by scientific research, as a 1992 study at Cornell University found that the significant difference in pay equity between executives and employees is strongly correlated with product quality. A sense of inequality can be felt by employees which hinder their motivation, causing them to put significantly less effort into their work.

How It Destroys Corporations

Not only does high executive compensation hurt employees and the working class, it also magnifies the problem that this pay structure is often introduced to solve. Executives become entirely motivated by their own self-interest in pursuit of bonuses to the determinant of their own corporation’s success. This comes in the form of causing serious long-term damage to shareholders, index, and pension funds. This incentive-based pay structure puts a significant emphasis towards corporations reaching short-term goals, focusing on their earnings per share instead of long-term strategies and innovation.

One result would be executives being more motivated to artificially inflate their earnings per share, often through spending exorbitant amounts of money on stock buybacks or other forms of financial misrepresentation which provide no benefit to long-term investors. An example of this would be General Electric, who spent over $81 billion on stock buybacks instead of strategic investments that would benefit the company in the long-term. There also exist many cases of executives cost-cutting to inflate share prices, which can inflate the value of a company through lowering their operating expenses and laying off employees or reducing their wages. Cost-cutting continues as share prices rise and executives are paid more, until corporations eventually feel the impacts of these cuts and shareholders suffer losses. An example of this would be the retail grocery store chain, Albertsons, where the CEO received a 68 percent increase in his salary while the company laid off 1,300 workers and closed 95 stores.

Conflicts of Interest and Exploitation

Furthermore, accounting fraud and a conflict of interest between the corporation and large shareholders can result from high executive compensation. Due to the main compensation for CEOs coming from low-priced stock options, they can easily control a large sum of a company’s stock. This can promote manipulation and other unethical means to inflate the price of these shares. As a result, there is a much larger incentive for executives to perform unethical accounting practices and falsely report their earnings to hide low growth. This could lead to the company and executives receiving large fines, which could leave a corporation unable to financially recover and negatively affect shareholders.

In conclusion, high executive compensation not only allows executives to easily exploit the system, but it also has drastic implications on employee productivity and the long-term success of corporations.

References

- APA PsycNet. (n.d.). Psycnet.apa.org. Retrieved October 18, 2021, from https://psycnet.apa.org/record/1992-45010-001

- Cowherd, D. M., & Levine, D. I. (1992). Product Quality and Pay Equity Between Lower-Level Employees and Top Management: An Investigation of Distributive Justice Theory. Administrative Science Quarterly, 37(2), 302. https://doi.org/10.2307/2393226

- Alsin, A. (2020, December 15). What’s The Harm In Excessive CEO Pay? Answer: Long-Term Damage To Shareholders And Pension Funds. Forbes. Retrieved October 18, 2021, from https://www.forbes.com/sites/aalsin/2017/09/07/whats-the-harm-in-excessive-ceo-pay-answer-long-term-damage-to-shareholders-and-pension-funds/?sh=4c8b0f4e4aea

- Executive Compensation: A Survey of Theory and Evidence. (2017b, September 6). The Harvard Law School Forum on Corporate Governance. Retrieved October 18, 2021, from https://corpgov.law.harvard.edu/2017/09/06/executive-compensation-a-survey-of-theory-and-evidence/

- United Food and Commercial Workers International Union. (2020, August 24). LARRY JOHNSTON TAKES MONEY AND RUNS, LEAVING WORKERS IN THE LURCH. The United Food & Commercial Workers International Union. Retrieved October 18, 2021, from https://www.ufcw.org/press-releases/larry-johnston-takes-money-and-runs-leaving-workers-in-the-lurch/